Stakeholders push for smarter revenue collection

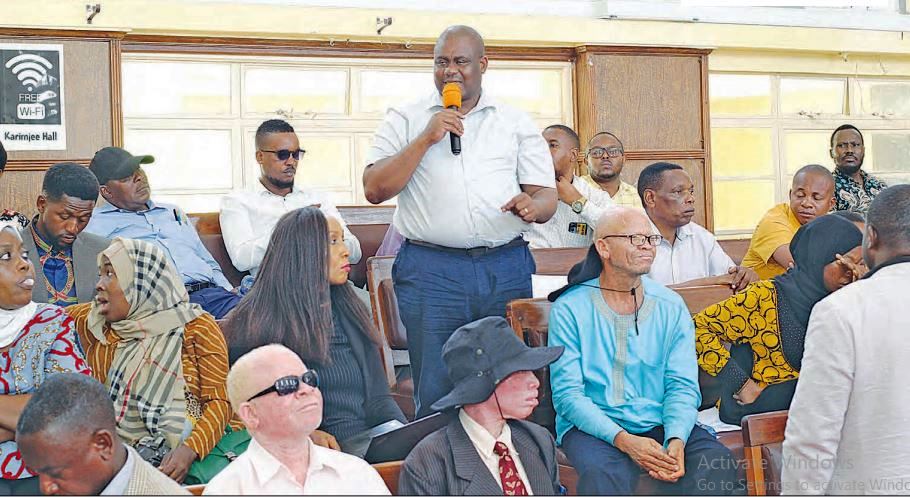

TANZANIA: STAKEHOLDERS are calling for significant changes, primarily smart revenue collection, as the President’s Commission on Tax Reforms embarks on an ambitious review of the nation’s tax systems.

Their proposals include adopting a more efficient tax payment system aimed at improving revenue collection, reducing administrative burdens and creating a more attractive environment for business and investment.

Stakeholders have raised concerns about the current tax systems, stating that they are burdensome and hinder a thriving business environment by creating unnecessary obstacles that make it difficult for businesses to operate smoothly and efficiently.They argue that the complexity, lack of transparency and frequent changes in tax regulations are causing significant challenges, particularly for small and medium-sized enterprises (SMEs).

The stakeholders which include business owners, industry groups and other relevant parties, pointed out that the cumbersome nature of the systems discourages investment, hampers growth and increases the cost of doing business. As a result, stakeholders have urged the government to reform and simplify the tax system.

They argue that such changes would streamline the collection process, create a more predictable business environment and improve compliance, leading to increased revenue. Specific proposals include a user-friendly approach that fosters transparency, reduces administrative burdens and enhances compliance rates.

Additionally, stakeholders have called for allocating space for street vendors, lowering import duties on buses, establishing tax systems for seafarers and providing more professional training for tax collectors, many of whom lack integrity.

Street vendors’ recommendations

Mr Steven Lusinde, ViceChairman of the Street Vendors Association of Tanzania said that the biggest challenge for street vendors in the country is the lack of designated spaces for doing business, which has essentially caused significant disruptions in their operations.

We have surrendered several areas for various projects, with the assurance that alternative spaces would be provided.

“However, to this day, we remain uncertain about our future, continuing to struggle without any concrete answers, despite various assurances from the government for better working conditions,” Mr Lusinde said.

He said, for instance the DDC area in Kariakoo was designated to create a design for stalls that could accommodate over 6,000 street vendors, which would significantly help reduce this challenge and increase revenue potential. However, he said; “No steps have been taken to implement this plan”.

Tanzania Business Owners Association’s (TABOA) recommendations

The TABOA’s Executive Secretary Mr Raymond Samson asked the government to lower buses import duty from the current 25 per cent to between 5.0 per cent and 10 per cent, with these payments being made in installments.

“By reducing these payments, it would increase the number of buses being imported, which would ultimately lead to higher tax collection,” he said.

He said that when a business owner imports buses, there are numerous upfront payments before the buses can even start operating. Furthermore, he proposed the introduction of a flat-rate tax, suggesting an annual payment of 1m/- for each bus.Similarly, they proposed the creation of a single payment window for municipal and township bus terminals and stands under the President’s Office, Regional Administration and Local Government (PO-RALG), covering the entire route the bus travels.

“When renewing our bus licences, the tax would be included in the renewal fee. This would eliminate the inconvenience of buses having to pay fees at every station, saving time and reducing disruptions, as buses are currently forced to stop at each station even when no passengers are disembarking,” he said.

Dar es Salaam Seafarers Association recommendations

The Secretary of the Dar es Salaam Seafarers Association, Mr Frank Linkamba, said that the current system does not allow seafarers to pay taxes, resulting in significant revenue losses for the government. He said that approximately 80 per cent of seafarers work abroad and do not pay taxes because they are not recognised within the local tax systems.

“Some of our neighbouring countries have monitoring desks where seafarers can present their employment contracts and salaries so that tax deductions can be made. This would increase tax collection,” he said.

He was discontented with the government deduction of taxes from a teacher earning 600,000/-, but allows a seafarer earning 2,500 US dollars to go untaxed.

“The minimum salary for a seafarer is 400 US dollars. However, if they work abroad, they can earn between 1,500 and 2,000 US dollars, including seafarers with primary or secondary school education,” he added.

Additionally, for example in Zanzibar, all seafarers have a system in place to receive their salaries through the People’s Bank of Zanzibar (PBZ), enabling the government to collect foreign currency.

However, on the mainland, the government does not collect any revenue from seafarers, nor does it know how many Tanzanians are working abroad in this sector.

“A good tax system will encourage seafarers to pay willingly and the nation will benefit from foreign currency,” he said.

He also stated that with an improved tax system, even foreign workers from abroad would be turned away, as locals would be able to perform those jobs and the revenue would stay within the country, unlike foreign workers who take their earnings home.

For More Information Visit https://dailynews.co.tz/stakeholders-push-for-smarter-revenue-collection/